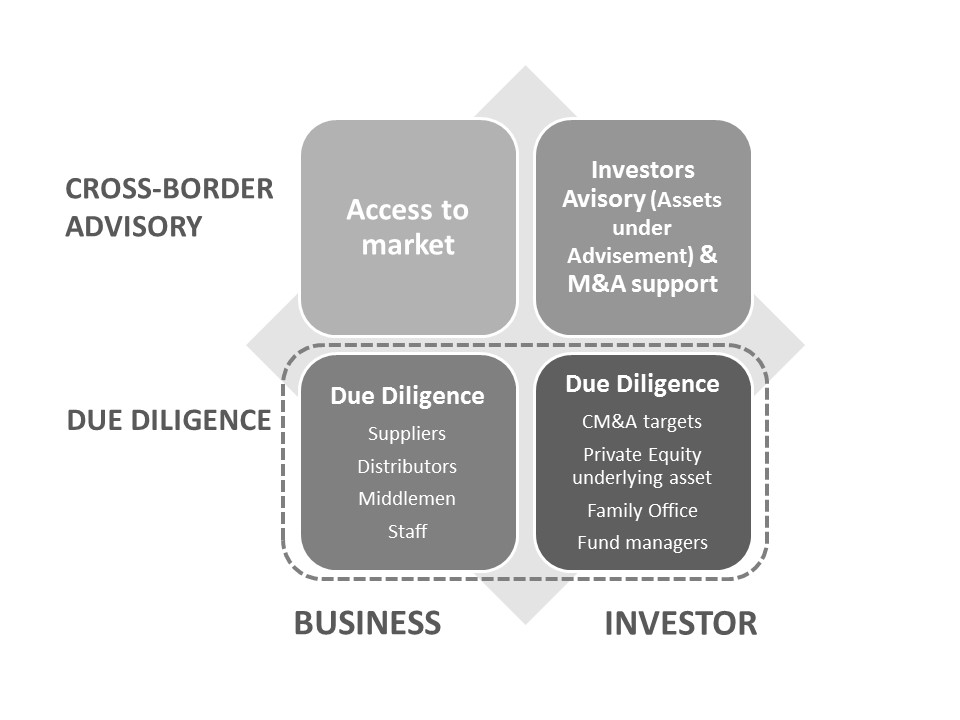

Our Services

We combine the rigor and discretion of an investigator, the technicality & track-record of investment bankers, the geopolitical knowledge of a Think-Tank, and an entrepreneurs’ mindset, with an international field network.

ABI gets involved into your entire value chain: advisors, investigators / auditors, and financial partners.

We’ve put together over 180 deals in 50 countries for over $ 950M in various sectors: finance, construction, real estate, retail, luxury, defense, F&B, FMCG, education.

We put our skills and our field technology at the service of large groups as well as SMEs, and we are committed to providing the same attention to both. We have established an attractive pricing policy for our customers.

ABI Transactions Intelligence Services

Seize growth opportunities, new markets

Strategic support : intelligence, feasibility, roadmap

Validation : due diligence

Raise capital and establish operational and financial partnerships

International Advisory Services

« Route to Market »:

Submit a new market:

– Implantation

– market growth potential & solvency assessment

– Country risk

– Identify key local and international stakeholders

– Competition

– Suppliers

– Legislators

– Identify “Barriers to entry” sticking points

– Generate a long list of potential targets: Distribution Partners; Companies in the acquisition, Joint Venture; Space sales, agents, VRPS, etc..

– Local Management assessment

Our references are numerous and strong in support, particularly in Africa and Middle East

Validation and Investigation tools

Several levels of validation tailored to your situation available to you, and in more than thirty countries:

– Validation of partners: proof of existence “background check” financial items, share, reputation, litigation, property and check international blacklists: financial regulation authorities, embargo lists, criminal, fraud, bankruptcy, etc..

– Screening: Tool developed by our partners allowing the automated assessment of a large number of batches from third parties (suppliers, customers, etc.) within a framework of compliance and risk management:

- Risk ranking: definition with you of the risk profiles of stocks and third-party flows, implementation of a risk scale

- Screening: Third parties at moderate risk are processed in the ASR tool (130 million companies in stock, 800 sanction lists, monitoring and daily update)

- Remediation: The profiles of third parties at moderate risk but with alert are processed by our ASR + tool, then by our RRR analysis: Removal (remediation of any false positives); Risk Analysis; Recommendations

- A controlled alert rate for controlled costs, and your risk management is in good hands.

Advanced Due Diligence

Intervention and enhanced human analysis, call employees and partners, performance analysis.

Case study: Mission Greenfield project

Due diligence for the construction of a hotel project Greenfield

Validate a hotel project Greenfield’s feasibility : partner, land, licenses

– Identify the target and its environment:

– Proof of existence: Registration, Licensing, HQ, subsidiaries,

– Ownership structure, funding

– Management

Acquisition or investment due diligence

Internal Audit for third parties, interviews, on-site visit, Due Diligence process as part of entity creation, acquisitions, joint ventures, or validation of an investment fund.

Case study: Due diligence on alternative investment funds

– Validate a fund, its officers, investment strategy, exposure to risks,

– Identify the target and its environment:

– Proof of existence : Registration, Licensing, HQ, subsidiaries,

– Ownership structure, funding

– Management

– Identify liabilities and business relationships

– Assessment Stakeholders: Customers, suppliers

– Online and offline Reputation

– Income statements, payment terms

– Litigation record

– Check Backgroud: black lists, embargo, etc.

– Analyze investment methodology

– Grid risk, VaR and other relevant indicators

– Track record of investment and exit

– Governance, management methods

– Gap Analysis:

– Performance differencial displayed / reality

– Grid commissions and managements costs

– Gap Analysis: Analyze the value of rights and licenses, the accessibility of the terrain

– Analyze and interpret texts of licenses and associated legal risks

– Check the actual availability of the land (real owners and beneficial owners, customary rights, etc.)

– Identify the real decision-makers on permits and hotel operation

Fight against fraud and litigation

Track 2″: Fight against fraud, scams, disputes between parties

ABI helps you avoid fraud during the entire cycle of your relationships with your customers / suppliers / acquisition / Partner Target:

– Upon entry into relationship

– During the relationship, by implementing predictive behavioral models and generators operational tools alerts for reducing the possible attempts of fraud.

– After the relationship or acquisition, ensuring a permanent standby to measure.

– On an e-commerce site attempts fraudulent orders on commercial websites amounted to 1.7 billion euros in 2012.

– On a social network

Our teams are active members of the prestigious ACFE (Association of Certified Fraud Examiners which is the team that brought to light the massive fraud B. Madoff despite lax US authorities at that time).

We have participated in several missions “Track 2” identification of fraud, corruption schemes, debt collection and various disputes including:

– In Yemen

– In the United Arab Emirates

– In Luxembourg

– In Swiss

– In France

– In Gabon

– In Malawi

In the following areas:

Oil industry

Finance

Wine and spirits

Agribusiness

Our Services Matrix